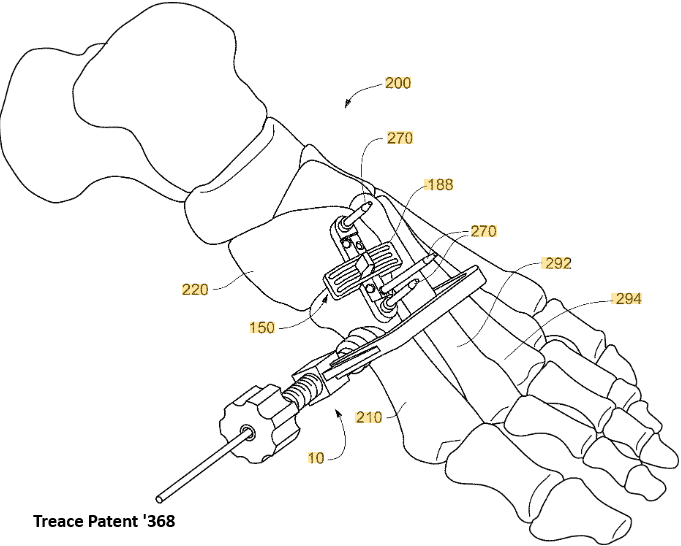

Missouri-based company, Precision Planter Solutions, LLC, has filed a lawsuit in the U.S. District Court of Northern Indiana against Solid Rock AG Solutions, Inc., accusing the company of patent infringement. According to the complaint, Precision Planter owns a patent—U.S. Patent No. 12,274,187—that describes a method and apparatus aimed at extending the service life of agricultural planters by addressing wear and tear in pivoting support arms. The patented technology seeks to solve problems caused by constant motion over uneven farmland, which can lead to equipment damage and costly repairs.

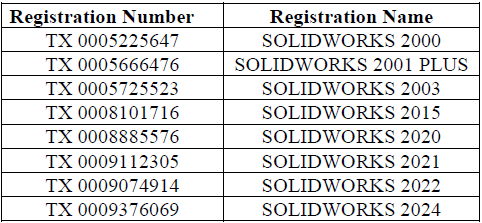

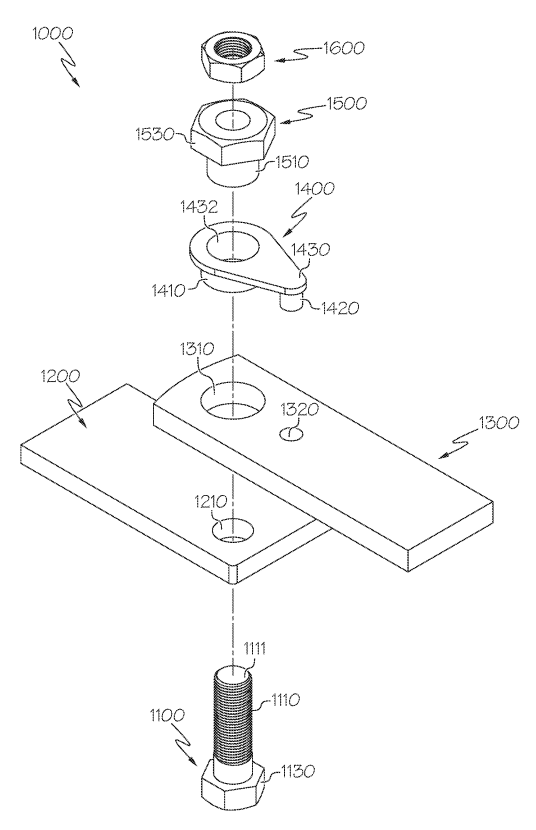

Missouri-based company, Precision Planter Solutions, LLC, has filed a lawsuit in the U.S. District Court of Northern Indiana against Solid Rock AG Solutions, Inc., accusing the company of patent infringement. According to the complaint, Precision Planter owns a patent—U.S. Patent No. 12,274,187—that describes a method and apparatus aimed at extending the service life of agricultural planters by addressing wear and tear in pivoting support arms. The patented technology seeks to solve problems caused by constant motion over uneven farmland, which can lead to equipment damage and costly repairs.

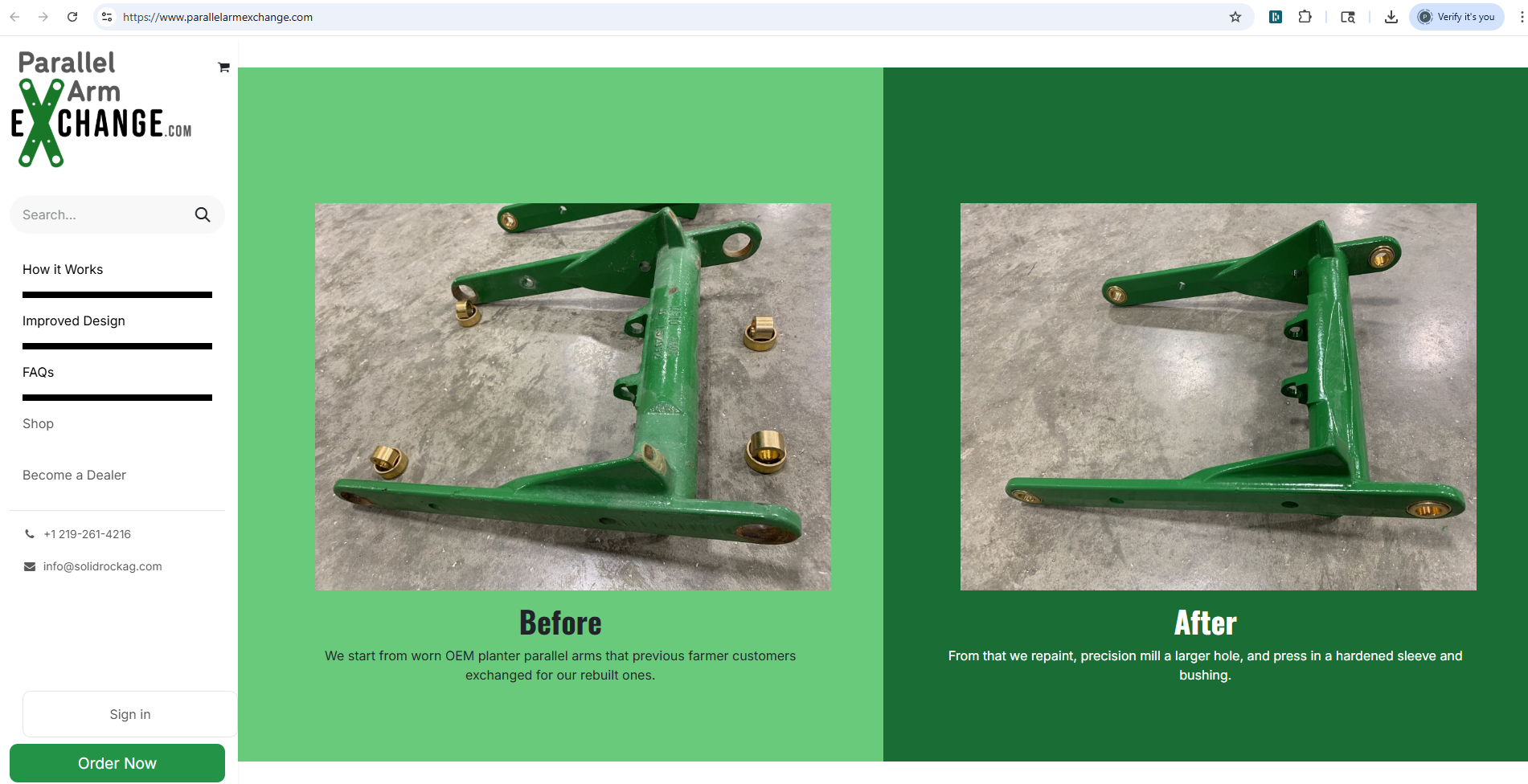

Precision Planter alleges that Solid Rock is making, using, selling, and offering to sell products that unlawfully use the technology covered by this patent. The complaint specifically points to Solid Rock’s parallel arm rebuilding and exchange systems, sold and promoted through its websites, which Precision Planter says match each part of its patented design. Images and descriptions from the websites are cited to support these claims, including the use of metallic collars and bushings that fit the specifications outlined in the patent.

The lawsuit claims that Solid Rock’s actions violate federal patent law and that the infringement is ongoing and willful. Precision Planter argues that this has caused financial damage, loss of market share, and harm to its reputation, and that these harms will continue unless the court intervenes.